Thursday, January 29, 2009

Mortgage Refinance Applications Jump & Mortgage Refinance Originations Slump

Tuesday, January 27, 2009

FHA Originations Increase in December

Wednesday, January 21, 2009

Your Local Bank Provides Better Mortgage Deals.

click for larger view

click for larger viewWednesday, January 14, 2009

Monarch Home Funding Gains in November

This is quite an accomplishment given that the Veteran's Administration mortgage market slowed for Virginia Beach in November. The total of Veteran's Administration mortgage originations dropped to 517 from 702 in October. The chart below illustrates the dip in November originations.

This is quite an accomplishment given that the Veteran's Administration mortgage market slowed for Virginia Beach in November. The total of Veteran's Administration mortgage originations dropped to 517 from 702 in October. The chart below illustrates the dip in November originations.

Monday, January 12, 2009

Where Have the Jumbo Mortgages Gone? - Part 2

Early this year, the Economic Stimulus Act of 2008 (Public Law 110-185) included an increase of FHA Mortgage loan amount limits. One result of this law was that many mortgages that may have been financed only through conventional mortgages (typically known as jumbo mortgages) became eligible for FHA mortgage insurance. The chart shows the monthly increases in the number of jumbo size (mortgages $417,000 or more) since 2006. The jumbo size FHA mortgages prior to the law (before February 2008) include mortgages on two, three, or four family residential units which allowed for higher mortgage loan limits cases.

An FHA mortgage for everybody!

Friday, January 9, 2009

FHA Average Mortgage Amount Plateaus

This is an interesting trend considering the FHA loan limit was raised to over $729,000 in some high cost counties. Take a look at what is going on in Fairfax County, Virginia (FHA loan limit of $729,750). After an initial increase this year, the average amounts have been declining the last few months. Is this a function of further declining home values or something else?

This is an interesting trend considering the FHA loan limit was raised to over $729,000 in some high cost counties. Take a look at what is going on in Fairfax County, Virginia (FHA loan limit of $729,750). After an initial increase this year, the average amounts have been declining the last few months. Is this a function of further declining home values or something else?

Click on the image for a larger view.

Thursday, January 8, 2009

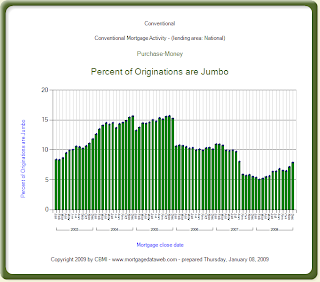

Where oh Where Has Our Jumbo Mortgage Business Gone?

click on chart for larger image

But!

But! In recent months the number of all conventional mortgages including jumbo mortgages have fallen off a cliff!

Wednesday, January 7, 2009

Navy Federal Originations Double in Fairfax County

Click on the image below for a larger view.

This increase increase in originations led to a significant increase in their Fairfax County market share, as the chart below shows.

Click on the image for a larger view.

This is an important development for Navy Federal Credit Union , the world's largest credit union. Navy Federal Credit Union has announced an even larger commitment in mortgage lending for 2009. Click here to view the Navy Federal Credit Union press release. We will be following this in the coming months to see if their monthly originations and market share continue to rise.